The Consistent Wealth-Building Power of Real Estate

In the world of investment, where markets fluctuate and economic landscapes evolve, real estate stands out as a resilient and consistent wealth-building asset class. Beyond the allure of physical assets, there are fundamental reasons why real estate has proven to be a steadfast generator of wealth over time. Let's delve into why real estate has maintained its reputation as a reliable avenue for wealth accumulation, often outshining other asset classes.

1. Stability in Tangible Assets: A Fortress in Uncertain Times

Real estate's enduring appeal lies in the tangible nature of its assets, creating a fortress of stability in the face of economic uncertainties. Unlike the abstract valuations of stocks or the fluctuating prices of commodities, real estate investments are anchored in physical structures and the land they occupy. The inherent solidity of bricks and mortar provides a sense of permanence that resonates with investors seeking a reliable foundation for their wealth.

A Hedge Against Inflation

Real estate's tangible nature acts as a natural hedge against inflation. As the cost of goods and services rises, the value of physical assets tends to follow suit. Property values often appreciate over time, reflecting the increasing cost of construction materials and labor. This intrinsic connection to tangible assets shields investors from the erosive effects of inflation, ensuring that the real value of their investment remains intact and continues to grow.

Weathering Economic Storms

Real estate has historically demonstrated its ability to weather economic storms. While other assets may experience sharp declines during economic downturns, well-chosen real estate investments often exhibit a more tempered response. The long-term nature of real estate value appreciation means that, even in the face of short-term market volatility, the overall trajectory remains positive, providing investors with a sense of security during turbulent times.

2. Diversification and Risk Mitigation: Crafting a Robust Investment Portfolio

Real estate's unique ability to facilitate effective diversification within an investment portfolio serves as a cornerstone for building lasting wealth. The power of diversification lies in spreading investments across different asset classes, and real estate offers a distinctive set of advantages in this regard.

Varied Real Estate Sectors

Real estate is a multifaceted asset class, encompassing various sectors such as residential, commercial, industrial, and retail. Each sector reacts differently to market dynamics and economic cycles. By strategically diversifying across these sectors, investors can mitigate risks associated with the performance of a specific market segment. For instance, if the residential market experiences a downturn, a well-diversified real estate portfolio may find stability through a resilient commercial sector.

Geographic Diversification

Diversification isn't limited to property types; it also extends to geographic locations. Real estate markets can vary significantly based on regional economic conditions, population growth, and local development trends. By investing in properties across different regions, investors can reduce exposure to localized risks. A well-diversified real estate portfolio may include properties in both established, stable markets and emerging, high-growth areas, providing a balance that helps navigate shifting economic landscapes.

Enhanced Portfolio Resilience

The essence of diversification is not only to spread risk but also to enhance the overall resilience of an investment portfolio. Including real estate alongside traditional asset classes like stocks and bonds creates a more robust and balanced portfolio. The combination of different asset types with varying risk-return profiles can lead to a smoother overall investment experience, reducing the impact of any single asset class's underperformance.

3. Income Generation through Rental Yields: The Engine of Consistent Cash Flow

One of the distinctive features that sets real estate apart as a wealth-building powerhouse is its unparalleled capacity to generate a steady stream of income through rental yields. This income, often referred to as the "mailbox money" of real estate, is a fundamental component of a successful wealth-building strategy.

Passive Income and Financial Freedom

Real estate's unique ability to generate passive income is a key factor in its appeal to investors seeking financial freedom. By building a portfolio of rental properties, investors can create a sustainable income stream that covers property expenses, mortgage payments, and leaves room for profit. This passive income not only supports ongoing property management but also provides investors with the flexibility to pursue other opportunities, diversify their investments, or enjoy a more relaxed lifestyle.

Inflation Hedge and Rental Appreciation

Rental income has an intrinsic advantage when it comes to hedging against inflation. Lease agreements often include rent escalation clauses, allowing landlords to adjust rents periodically to keep pace with rising living costs. This built-in mechanism ensures that rental income grows over time, providing a natural hedge against the eroding effects of inflation. As the cost of living increases, so does the income generated from rental properties.

Long-Term Wealth Accumulation

The compounding effect of consistent rental income over the long term is a powerful wealth-building mechanism. As investors reinvest rental proceeds, acquire additional properties, or pay down mortgages, their real estate portfolio grows, leading to an exponential increase in income-generating potential. This compounding effect positions real estate as a vehicle for not only preserving wealth but also steadily accumulating it over the years.

4. Leverage and Increased Return Potential: Amplifying Wealth through Strategic Financing

Real estate's unique characteristic of allowing investors to leverage their capital is a powerful factor that distinguishes it from many other asset classes. Leverage, when used strategically, has the potential to amplify returns and significantly enhance the wealth-building trajectory of real estate investments.

Access to Greater Assets with Less Capital

Leverage in real estate involves using borrowed capital, typically in the form of mortgages, to increase the purchasing power of an investor. Unlike other investments that may require the full upfront payment, real estate allows individuals to control substantial assets with a relatively small initial investment. This access to greater assets with less capital outlay provides an inherent advantage, allowing investors to diversify their portfolio and participate in more lucrative opportunities.

Magnifying Returns on Investment

The ability to control a property with borrowed funds means that any increase in the property's value translates into a higher return on the investor's initial investment. For example, if an investor puts down a 20% down payment on a property, and the property appreciates by 10%, the return on investment is not just 10% on the down payment but 50% (10% of the property's total value). This magnification of returns becomes particularly impactful in markets experiencing appreciable property value growth.

Risk Management and Liquidity

While leverage amplifies returns, it's important to note that it also introduces an element of risk. However, when used judiciously, leverage can be a tool for risk management. For instance, financing can help investors spread their capital across multiple properties, reducing exposure to the potential pitfalls of a single investment. Additionally, real estate's intrinsic value and the ability to generate income provide a degree of liquidity and collateral that may not be present in other leveraged investments.

5. Long-Term Appreciation: Building Wealth Through Value Growth

Real estate's historical track record of long-term appreciation has solidified its status as a reliable vehicle for building lasting wealth. While short-term market fluctuations are inevitable, the overarching trend in real estate has consistently shown a propensity for value growth, making it a compelling choice for investors with a patient and forward-looking perspective.

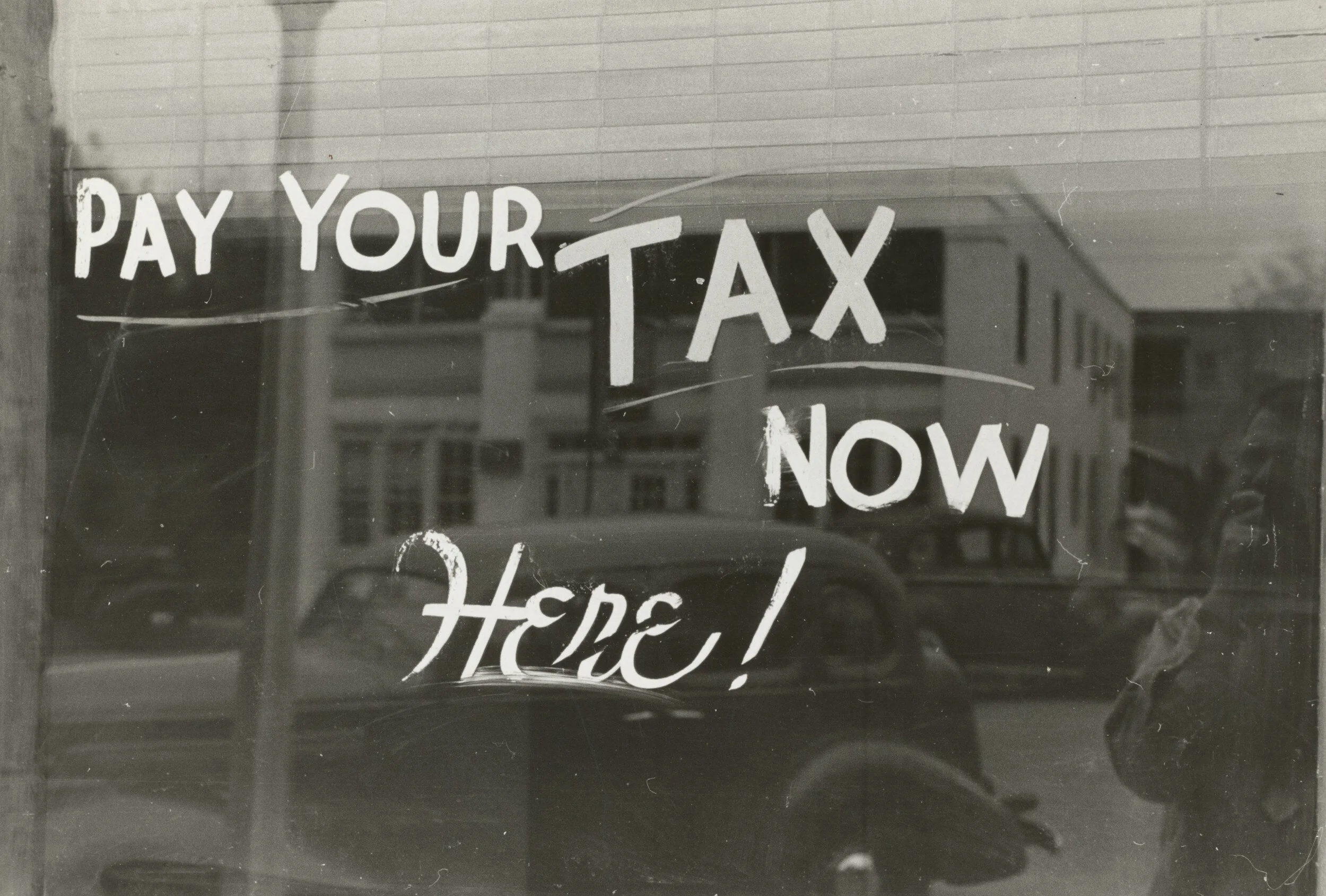

6. Tax Advantages and Incentives: Maximizing Returns Through Fiscal Strategies

Real estate's appeal as a wealth-building asset class is not limited to its inherent value growth; it also offers a myriad of tax advantages and incentives that can significantly enhance an investor's overall return on investment. Understanding and leveraging these fiscal strategies can be a key driver in maximizing the wealth-building potential of real estate.

Depreciation Allowances

Real estate investors can benefit from depreciation allowances, which allow them to deduct a portion of the property's value over time as it is deemed to lose value due to wear and tear. This non-cash expense can offset rental income, reducing the investor's taxable income. Depreciation is particularly advantageous in the context of real estate, where the physical structure of the property can be depreciated even as its market value appreciates, providing investors with a valuable tax shield.

Capital Gains Tax Benefits

Profit from the sale of real estate is typically subject to capital gains tax. However, there are strategies to minimize or defer these taxes. For instance, through a 1031 exchange, investors can sell a property and reinvest the proceeds in a similar, like-kind property without immediate tax consequences. This allows investors to defer capital gains taxes and retain more capital for reinvestment, promoting the continuous growth of their real estate portfolio.

In conclusion, real estate's enduring appeal as a wealth-building asset class is rooted in its stability, income-generating potential, diversification benefits, leverage opportunities, long-term appreciation, and tax advantages. As investors navigate the intricate landscape of wealth creation, the steadfast allure of real estate as a wealth-building tool continues to stand the test of time. It remains a beacon of stability and consistency, guiding investors toward the prosperous realization of their financial goals.

If you want to start building long-term wealth now, let’s win together!